We've updated our Privacy Policy, which will go in to effect on September 1, 2022. The surety company issues the actual bond and pays any claims made against it, at least initially. Corrections? Each name will list a specific dollar amount for which that individual is being bonded. Commercial bond a general classification of bonds that refers to all bonds other than contract and performance bonds. The obligee for bid, performance and payment bonds is the project owner. This glossary entry focuses on one of those parties the obligee. Environmental bonds guarantee that contractors and other service providers will comply with federal, state, and local regulations and environmental policies to prevent or repair environmental damage by covering construction projects and hazardous materials included in the bond terms.

Blanket public official bonds cover all public employees of the public entity stated on the bond to the stated amount of the bond. The surety also ensures timely payment once the principal completes the task. Work in Progress Reports, also known as Work-On-Hand ReportsA type of financial statement or schedule which lists a contractors jobs in progress. The risk of loss in surety bonding is the failure of persons or entities to perform obligations they have assumed.

Updates? In the case of commercial bonds, it's typically the federal, state, or local agency responsible for regulating your industry by awarding professional licenses. A conservator is a person, official, or institution designated to take over and protect the interest of an incompetent or minor. Chapter 11: calls for the reorganization of a business and the debtor remains in possession of the assets after the filing of a plan for the reorganization. Attachment is the legal process of taking possession of a defendants property when the property is in dispute. Indemnity is a contractual obligation of one party to compensate the loss occurred to the other party due to the act of the indemnitor or any other party. It covers losses.

In certain situations, a person may be appointed as a guardian of a minor. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Penalty is a term used to refer to the monetary size or limit of bond. 11440 Carmel Commons Blvd.

Save my name, email, and website in this browser for the next time I comment. Adequate expertisefor the completion of the project. An obligor, also known as a debtor, is a person or entity who is legally or contractually obliged to provide a benefit or payment to another. Loss Payee Has the meaning specified in Section 13.02(b)(i) of the Lease. In the event of a default by the supplier, the surety indemnifies the purchaser of the supplies against the resulting loss. These bonds guarantee whatever the underlying statute, state law, municipal ordinance, or regulation requires. Bonds are issued, once contractors meet the required conditions. You are free to use this image on your website, templates, etc, Please provide us with an attribution link. This method may be used when the contractor would not otherwise qualify for a bond. These bonds cover losses arising from employee dishonesty and indemnify the principal for losses caused by the dishonest actions of its employees. However, in addition to the required repayment of interest and principal, many holders of corporate debt are also contractually required to meet other requirements. Using a position instead of a name will reduce the paperwork involved year-to-year. Our thoroughly developed online system was built for insurance agents like you. An administrator is a person legally vested with the right of administration of an estate. The obligee for fidelity bonds will typically be your customers client if they are providing some sort of service and have access to their clients personal or business property. OCEAN MARINE INSURANCE Insurance protecting against damage or loss of subject matter of insurance as a result of perils of the sea. Performance bonds guarantee the performance of the terms of a contract. OWNER'S, LANDLORD'S, AND TENANT'S LIABILITY INSURANCE (OL&T) Insurance against loss due to claims for damages against owners, landlords, or tenants arising out of ownership, maintenance, or use of specified premises. An affirmative covenant is something that the obligor is required to do, such as the need to hit specific performance benchmarks.

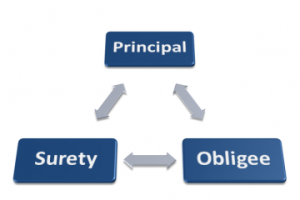

The borrower could be an individual like a home loan seeker or a corporate body borrowing funds for business expansion. According to data from The Surety and Fidelity Association of America, obligees have been paid more than $25 billion since 1998. The surety fully expects the principal to undertake its obligations successfully. OTHER INSURANCE CLAUSE A clause in an insurance policy stating the effect thereon when there are two or more policies covering the same risk; e.g., how the policies will respond in case of loss. Blanket bonds guarantee the honesty of all of the employees of an entity to the stated amount of the bond. Even if XYZ contractor fails to satisfy the contractual terms, the obligee is compensated. Simply login to your account and use our keyword search to find your bond in our database. To understand how surety bonds work you must know about the three parties involved. The borrower could be an individual like a home loan seeker or a corporate body borrowing funds for business expansion.

A fiduciary is a person appointed to act in the best interests of another. Construction contracts constitute most of these bonds. OVER INSURANCE A risk insured for more than its fair or reasonable value and which may create carelessness on the part of the insured or increase the moral hazard possibilities. A surety bond is a promise to complete a specific taskas per the contractors terms. Each name will list a specific dollar amount for which that individual is being bonded. Since final loss costs may take years to develop, the bond guarantees payment of the final premium amount. Since these bond issues are contractual obligations, obligors may have very little leeway in terms of deferring principal repayments, interest payments or circumventing covenants. OCCUPATIONAL ACCIDENT An accident occurring in the course of one's employment and caused by inherent or related hazards. Surety BondsSurety bonds are three-party agreements in which the issuer of the bond (the surety) joins with the second party (the principal) in guaranteeing to a third party (the obligee) the fulfillment of an obligation on the part of the principal.

Login details for this Free course will be emailed to you. The NC DMV requires the bond to ensure the dealer complies with licensing regulations and operates their business ethically.

For example, if your customer is a motor vehicle dealer in North Carolina they will need to obtain a $50,000 Motor Vehicle Dealer Bond as required by the North Carolina Department of Motor Vehicles (NC DMV). Replevin is an action of a law used to recover specific personal property. If your customer is acting as a subcontractor on a project that requires bonding, the obligee will be the general contractor for the project. The guarantee protects the local USA authority. It is an agreement between three partiesa third party assures the obligee that the principal will fulfill documented obligations. Additional Insured is defined in Section D of Annex D to the Lease. Insurance carrier means any stock company, mutual company, or reciprocal or interinsurance exchange authorized to write or carry on the business of workers' compensation insurance in this state, and includes an individual own risk employer or group self-insurance association duly authorized by the Commission to self fund its workers' compensation obligations. An obligee is the party (person, corporation or government agency) to whom a bond is given. OCCUPANCY In insurance terminology, this refers to the type of property and how it is used. In a financial context, the term "obligor" refers to a bond issuer who is contractually bound to make all principal repayments and interest payments on outstanding debt. Required fields are marked *. In order to ensure the completion of work, a bond is used as insurance. The obligee sets the bonding requirement, and the principal purchases the bond through a surety company. Usually, the surety is an insurance company that issues bonds. The surety is released from all accrued liability if the surety cancels the bond and the principal later posts an acceptable replacement security. These bonds may occasionally include a guarantee of efficient or successful operation or other obligations. The surety prequalifies a prospective principal on the basis of the principals credit strength, ability to perform and character. Health insurance policy means any group health, sickness or accident policy or subscriber contract or certificate offered to groups of fifty-one (51) or more employes issued by an entity subject to any one of the following: Blanket insurance policy means a group policy covering a defined class of. An executor is a person appointed to execute a will. The third-party assures the obligee that the principal will complete the project in accordance with the terms. Travel insurance means coverage for personal risks incidental to planned travel, including one or more of the following: Medical malpractice insurance means insurance against legal liability incident to the practice and provision of a medical service other than the practice and provision of a dental service. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2022 . Whoever is designated as the obligee receives financial compensation when valid claims are filed against the bond. The term obligee trips up many insurance agents the first time they hear it. A surety bond is a contract that protects a creditor from non-performance or non-payment. An employer may comply with these laws by purchasing insurance or self insuring by posting a workers compensation bond to guarantee payment of benefits to employees. Commercial bonds cover obligations typically required by law or regulation. Bank depository bonds guarantee the deposit of public funds. To find your customers obligee, simply examine your customers bond form and the obligee will generally be listed at the very top of the first page. This provision safeguards an obligee in case the principal fails to comply with the agreed terms. A third party provides security for both parties. Large deductible plans is a type of insurance program bond in which the insurer pays all losses, including those that fall within the deductible, and seeks reimbursement from the policyholder on a monthly or quarterly basis. Once the bond is active, the principal bears the responsibility for paying any claims made against the bond by the obligee. Plaintiff bonds are required of a plaintiff in an action of law. As a result, most bond obligors take their debt obligations very seriously. A minor is a person who is not of legal majority age. This compensation may impact how and where listings appear. This language is typical for license bonds in industries that can expose the public to financial harm. To acquire a surety bond (insurance) the principal must meet the following requirements: The bond rider is the only legitimate method of updating surety documentation. Corporate valuation, Investment Banking, Accounting, CFA Calculation and others (Course Provider - EDUCBA), * Please provide your correct email id. The 1974 Employee Retirement Income Security Act (ERISA) created a requirement for a bond to be posted in the amount of ten percent of the funds on the fiduciary of pension funds and profit-sharing plans. An affirmative covenant is something that the obligor is required to do, such as the need to hit specific performance benchmarks.

Environmental Insurance Policy With respect to any Mortgaged Property or Serviced REO Property, any insurance policy covering pollution conditions and/or other environmental conditions that is maintained from time to time in respect of such Mortgaged Property or Serviced REO Property, as the case may be, for the benefit of, among others, the Trustee on behalf of the Certificateholders. This type of bond may be used to bond certain positions that have a high amount of turnover. Surety bonds are mandatory for entering into contracts with government agencies, regulation departments, state courts, federal courts, and general contractors. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Most often, the obligee will be a federal, state, or local government agency who is requiring your customer to purchase a bond as a prerequisite to obtaining a business license or permit. read more. A negative covenant is restrictive in that it stops the obligor from doing something, such as restructuring the leadership of the organization. These bonds provide financial assurance that the bid has been submitted in good faith and that the contractor will enter into a contract at the price bid. FHA Insurance The contractual obligation of FHA respecting the insurance of an FHA Loan pursuant to the National Housing Act, as amended. In case of failure, the surety will pay compensation to the oblige. A bond violation is a breach of the terms of a surety agreement where one party causes damage to the other. The third party or surety is usually an insurance company. A surety acts as a middleman between the two partiesprincipal and obligee. Blanket position bonds guarantee the honesty of each of the employees of an entity stated on the bond to the stated amount of the bond. A surety bond is a legal agreement that assures the obligee that the principal will complete the work. Notary bonds or notary public bonds include bonds that are required by statutes to protect against losses resulting from the improper actions of notaries. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Error rectification in the original bond.

As you might have guessed, most claims are filed by the obligee listed on the bond form. In such a scenario, the surety company must pay the local USA authority, mitigating the incurred losses. OPEN CARGO POLICY A policy that covers all goods shipped or received by the insured during the policys term.OPEN END POLICY A policy having no stated expiration date; it continues to be in effect until canceled. In 1935, congress passed The Miller Act which requires contractors to obtain payment and performance bonds on all qualified federal public works projects that exceed $100,000. The following changes can be made: Now let us look at an example to understand the practical application. This way, the principal can decide upon the appropriate bond amount. A premium is a sum of money paid as consideration for an insurance policy or bond. These bonds frequently incorporate payment bond (labor and materials) and maintenance bond liability. Surety bonds act as a three party contract between the principal (your customer), the surety company, and the obligee. Each bond is unique to the circumstances at hand. You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Surety Bond (wallstreetmojo.com). Often they require the posting of collateral to be written. Defendant bonds counteract the effect of the bond that the plaintiff has furnished. Material Insurance Subsidiary means a Material Subsidiary that is also an Insurance Subsidiary. Then, the contractor furnishes relevant financial records (with the help of a CPA) to qualify for the guarantee. Treasury ListingA financial rating published by the federal government that lists the maximum size of federal bond a surety is allowed to write. A pension is a fixed sum of money regularly paid to a person. Similarly, the principal must perform a cost-benefit analysis for each construction project. The obligee for these bonds is usually the county probate court where the estate is filed. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. The principal requires a formal assurance from a surety; only then will the obligee proceed with the business activityBusiness ActivityBusiness activities refer to the activities performed by businesses to make a profit and ensure business continuity. The plaintiff is a person or institution that brings an action in a court of law. Like any other insurance, this also provides coverage in exchange for regular premium payments from the insured. Viking Bond Service does not share or release email addresses, phone numbers or ANY other personal information to unauthorized third parties. OUTAGE INSURANCE Insurance against loss due to failure of machinery to operate. So now we know what an obligee is, but who exactly are they? Fidelity bonds, commonly known as employee dishonesty bonds, are not required by any government agency. Investopedia does not include all offers available in the marketplace. Bankruptcy trustee bonds provide a guarantee to the beneficiaries of the bankruptcy action that the bonded trustees, appointed in a bankruptcy proceeding, will perform their duties and handle the affairs according to the rulings of the court.

After payment is made, the surety company recoups its costs from the principal. Trustee BondsA trustee is a person named to manage a business assets and work with the business creditors. Errors and Omissions Insurance, commonly referred to as E&O, covers damages arising out of the insureds negligence, mistakes, or failure to take appropriate action in the performance of business or professional duties.

BondExchange makes obtaining a surety bond easy. For example, when someone files a valid claim, the surety bond company pays the obligee, who then pays the individual.

BondExchange makes obtaining a surety bond easy. For example, when someone files a valid claim, the surety bond company pays the obligee, who then pays the individual. Fill out an online application or contact us for more information. An obligee is usually the government; the principal is a contractor or business owner. D&O Liability Insurance Policies means all insurance policies (including any tail policy) of any of the Debtors for liability of any current or former directors, managers, officers, and members. Contract bonds protect a project owner by guaranteeing a contractors performance and payment for labor and materials. read more dishonors the obligation, the third party pays compensation to the obligee. for a construction project or service agreement. The Small Business Administration (SBA) has a program to help small and minority-owned contracting businesses obtain surety bonds. Performance bonds are financial instruments used by the investor to have guaranteed the contractor's successful execution of a contract. Traditional bond form: The surety is liable for payment of the principals workers compensation obligations occurring during the time the bond is in force. Principal This is the person or business required to be bonded by the obligee. They create the bond requirements, identifying what kind of bond is necessary and how large (monetarily) it must be. Company Insurance Policies has the meaning set forth in Section 4.15. Fiduciary bonds, in some cases referred to as probate bonds, are required by statutes, courts, or legal documents for the protection of those on whose behalf a fiduciary acts. Name schedule bonds use one bond, but attach a schedule of individual names of the bonded public officials. An obligor is a person or entity who is legally or contractually obliged to provide a benefit or payment to another. Maintenance bonds provide for the upkeep of the project for a specified period of time after the project is completed. Fiduciaries are often requested to furnish a bond to guarantee faithful performance of their duties. Dont have a login? These bonds guarantee against defective workmanship or materials. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

The Principal is obligated to the obligee to pay and/or perform according to a law, ordinance, rule, regulation, contract, license or permit.

Self-insured retention (SIR) is a type of insurance program that is commonly used with workers compensation insurance, general liability coverage or other liability coverage where limited coverage is available or coverage, when available, may not be affordable. A covenant is a commitment in a bond or other formal debt agreement that certain activities will or will not be undertaken.

Covenants can be either affirmative or negative. In regards to surety bonds, the obligee is the entity who is requiring your customer to purchase a bond. If the principal debtorDebtorA debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a bank, credit card company or goods supplier. OCCUPANCY PERMIT An endorsement on an insurance policy permitting occupancy that might otherwise suspend the contract or make it invalid. A fiduciary is a person appointed by the court to handle the affairs of persons who are not able to do so themselves. Generally, the bond guarantees honesty of employees. Obligee This is the party that requires the principal to provide the bond.

OBLIGOR One who is bound by an obligation; the promissory, or person obligated to do something.

The products comprising each are sold through the same type of distribution system agents and brokers. Save my name, email, and website in this browser for the next time I comment.