Its an era of advanced technology and businesses are spending on technology more than ever and the advanced technological capabilities of General Electric are also important factors behind its financial performance over the last several years remaining so consistent. Governments all over the world have focused on environmental protection and are implementing laws that punish businesses with a high carbon footprint. Competition has kept growing intense and it is the reason behind this heavy focus on R&D. The company also has a vast supply chain, providing it with better pricing power and bargaining position in the market.

GE has a diversified product portfolio, covering power system infrastructure, medical equipment, turbines/motors for aviation & aerospace, oil & gas production equipment. Industrial segment revenues rose $3.3 billion, or 3%, as increases at Oil & Gas, Renewable Energy, Aviation and Healthcare were offset partially by declines across Power, Transportation and Lighting. All these factors have turned businesses highly aggressive in terms of competition. There are several challenges to the growth of GE including rising protectionism. Revenue fell across some of these operational segments in 2017 and rose across a few. ; sensing technologies for industrial, security, and safety applications. This can be attributed to Philips stronger foothold and greater brand recognition and awareness than other international rivals like GE.

It employed 313000 people in 2017 of which 106000 people were employed in US alone.

In todays ever-complex and changing business environment, even small changes can have a massive impact on large companies like GE. However, GEs competitive advantage lies in its strong and established a foothold in the US market; however, Hitachis digital technologies and smart city solutions will majorly bring it to the top.In the diagnostic and imaging segment, Hitachi controls about 3 percent of the global market share as of 2017. The company trades in the NYSE as Koninklijke Philips N.V. [PHG] and has a market cap of $42.622 billion as of September 16th, 2021. Through smart leadership and innovative business practices, it has become a leading name in the industry.  Friendly political environment and good trade relationships facilitate business growth and profitability. From product quality to safety and environments well as labor there are several laws in each and every area that are creating immense pressure on the businesses and causing a lot of trouble for businesses trying to find flexibility. This commitment is embedded in our company at every levelfrom high-visibility initiatives such as Ecomagination and healthymagination to day-to-day safety and compliance management around the world, There is a sustainability steering committee at GE that, The bargaining power of buyers has seen significant rise in the 21st century. As of September 15th, 2021, its market value equity stood at $58.693 billion. It notes on its website, , At GE, sustainability means aligning our business strategy to meet societal needs while minimizing environmental impact and advancing social development. Moreover, varying societies and cultures also require businesses to have varying strategies for each geographical segment. In a world of technological advancement, companies are constantly looking for ways to stand out from the rest. On the other hand unfriendly political environment can have an adverse effect on businesses operating in foreign countries. Threat of substitute products and brands: The threat of substitute products and brands for General Electrical is moderate which is because of its large size, brand image and capabilities. This shows that the company is only as strong as its weakest link, not enduring major changes, such as Brexit or Trumps presidency. These leaders conduct regular meetings to talk on topics like competition and key challenges. These geographical business segments are many times run independently and many times controlled by a central headquarter. The global business environment is replete with challenges of various kinds and the forces challenging growth in global environment vary in nature.

Friendly political environment and good trade relationships facilitate business growth and profitability. From product quality to safety and environments well as labor there are several laws in each and every area that are creating immense pressure on the businesses and causing a lot of trouble for businesses trying to find flexibility. This commitment is embedded in our company at every levelfrom high-visibility initiatives such as Ecomagination and healthymagination to day-to-day safety and compliance management around the world, There is a sustainability steering committee at GE that, The bargaining power of buyers has seen significant rise in the 21st century. As of September 15th, 2021, its market value equity stood at $58.693 billion. It notes on its website, , At GE, sustainability means aligning our business strategy to meet societal needs while minimizing environmental impact and advancing social development. Moreover, varying societies and cultures also require businesses to have varying strategies for each geographical segment. In a world of technological advancement, companies are constantly looking for ways to stand out from the rest. On the other hand unfriendly political environment can have an adverse effect on businesses operating in foreign countries. Threat of substitute products and brands: The threat of substitute products and brands for General Electrical is moderate which is because of its large size, brand image and capabilities. This shows that the company is only as strong as its weakest link, not enduring major changes, such as Brexit or Trumps presidency. These leaders conduct regular meetings to talk on topics like competition and key challenges. These geographical business segments are many times run independently and many times controlled by a central headquarter. The global business environment is replete with challenges of various kinds and the forces challenging growth in global environment vary in nature.

Technology is more central to business than ever and digital has revolutionised the business world like none other thing. However, 2017 below lower results than its expectations and the brand would need to focus on a few specific areas to reduce the fluctuations across some of its business segments. GEs competitive advantage comes mainly firm advanced technologies and from power to transportation, the brand has set examples in all these areas. While GE takes good care of its supplier relationships and does its best to engage them, still it is important for suppliers to get its quality expectations and performance standards across other areas. Founded in 1847, Siemens is considered the pioneer of electrical engineering and was largely involved in laying out the nations electrical grid. 2017 income included a gain of $1.9 billion from the sale of GEs Water business as well as charges associated with businesses classified as held for sale including the substantial majority of GEs Lighting segment for $0.8 billion and two nonstrategic Aviation businesses for $0.6 billion. Resources and capabilities of General Electric: Global presence: GE is operating globally across 130 countries.

It manufactures MRI, CT, and X-ray machines for imaging and diagnosis. General Electric (GE) [NYSE: GE] is a multinational conglomerate in everything from oil and gas to aviation and medical equipment. Strong financial position Its advanced technologies and a global footprint have helped it maximise the brands financial performance and productivity. The importance of economic factors can be realised from the fact that economic factors affect the purchasing power of customers directly. Some of its main competitors include Emerson, United Technologies and Siemens AG. Its total orders for the same period were 20.5 billion Euros with an all-in free cash flow of 2.3 billion euros. Siemens competes with General electrics in almost every sector. Answer: GEs main competitor in the healthcare sector would be Siemens. Apart from that the business also maintains a high level of investment into R&D to grow the pace of innovation as well as to advance its business growth. 2016 revenues included gains of $3.1 billion from the sale of GE Appliances business and $0.4 billion from the sale of GE Asset Management. Apart from tax regimes and trade policies governments are affecting the fortune of businesses and especially the international businesses in several ways.

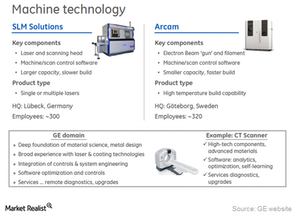

Friendly political environment and good trade relationships facilitate business growth and profitability. Answer: General electric main competitors include Siemens, Hitachi, Honeywell, 3M, and Phillips. He likes to blog and share his knowledge and research in business management, marketing, literature and other areas with his readers. Apart from these things, GE is investing in other areas like analytics software, machine learning capabilities as well as additive manufacturing equipment and services. Power and aviation are the main sources of revenue for the brand followed by healthcare, oil and gas and renewable energy. With its experience in multiple fields, GE can easily get into new segments powered by AI and robotics. Other areas where it achieved strong financial results were aviation, renewable energy & healthcare. Asian countries including India and China introduced new tax liabilities that have hit both small and big business hard. It is affecting business dynamics and in GEs business model it exists somewhere close to the core. It is because all the competing brands are quite aggressive in terms of marketing and research & development. GEs global brand recognition ensures that it is not constrained to a specific geographic location when seeking new business. A weaker U.S. dollar also caused an effect of $0.6 billion, partially offset by the net effects of dispositions of $3.4 billion, primarily attributable to Appliances. GE however, continued to perform well because of its technological capabilities and skilled human resources.

In 2021 alone, GE healthcare made a record 21 acquisitions, including Zionexa, a molecular imaging company based in Paris, France. While GEs aviation segment slumped in the 2020 financials, Honeywell saw revenues in this segment at 11.5 billion despite the global economy taking a hit due to Covid-19. It notes on its website, At GE, sustainability means aligning our business strategy to meet societal needs while minimizing environmental impact and advancing social development.

When Jack Welch used to be the CEO of GE, his focus was at simplifying the structure to reduce performance bottlenecks and let work and ideas flow smoothly. Legal pressures have resulted in higher pressure and less space for innovation. https://en.wikipedia.org/wiki/Baker_Hughes, https://www.ge.com/investor-relations/sites/default/files/GE_10-K_2017.pdf, https://www.gesustainability.com/how-ge-works/sustainability-at-ge/, https://www.supplychaindive.com/news/ge-reduce-inventory-manage-supply-chain-rigorously/510927/, https://www.hoovers.com/company-information/cs/company-profile.general_electric_company.8e594783fd3e6c6e.html. GE is present in more than 180 countries today with a workforce of more than 313000 working for it globally. Brand image & Equity: Brand image and brand equity that the brand has built are also important capabilities. GE also invests heavily in R&D which is crucial for any business if a brand wants fast expansion. Honeywells product portfolio comprises turbochargers and aviation products for transport and general aviation; controls and system solutions for industrial applications; home comfort solutions like thermostats, air purifiers, dehumidifiers, etc. No matter what reason youve come to Business Chronicler for, Johns here to give you all of the information you need to set yourself up on a path for success. Businesses have to formulate separate sales and marketing strategies for each market/region. While the overall revenue and profits saw a slight decline in 2017 compared to the previous year, the brand has still sustained its financial performance quite well over the last five years. Despite being so extensive and successful, GE should not let its size and success undermine its image of a company eager to learn and improve. If you are interested in reading more about other companies values, we have compiled a list of the most powerful and enduring mission statements. You can see that Aviation, healthcare and power are important segments where GE has consistently invested large sums in Research and development. Other countries have embraced change in sight of changing business scenario worldwide. GE has the potential to grow in these two segments considerably, given its deep understanding of market dynamics, customer preferences, etc. Moreover, it has got skilled and focused human resources who are an important force behind its global success. Hitachi has a strong presence in the medical sector as well.

Strong presence outside US The brand has managed a strong performance even in the non US markets. Governments and government agencies have grown increasingly aggressive and are now trying stricter controls against businesses worldwide from EU to Asia. The company has widespread brand recognition. Its penetration into digital media and consumer products is also growing at a fast pace. The company currently has its headquarters in Boston, Massachusetts. It has a major presence in energy, transportation, healthcare, and media. In a highly competitive global market, a company must have a strong positive balance sheet to ensure its longevity. If this metric holds, it also means that other segments in GEs product line will have to bear the brunt. The company has its presence in more than 70 countries worldwide, with headquarters in Charlotte, North Carolina. GE competes amidst a highly competitive business landscape. During the Trump regime, these relationships might have grown even worse. GE has a diversified product portfolio which reduces some of the competitive threat from the rival brands. Technological capabilities: Its technological capabilities are at the core of its business. These customers expect more from companies better services, customer support, responsiveness, etc. US is still lagging in several areas include trade policies and relationships with other nations. Further Expansion in middle eastern and Asian markets More opportunities are waiting for GE in the Middle Eastern and Asian markets. Sociocultural factors affect businesses in various ways and it is also because many businesses operate based on geographical segments. Digital Industrial service is an important domain where GE has a leadership status and where it has accumulated a strong backlog of $256.7 billion dollars. It also invest heavily in R&D to develop new product and innovative solutions. The company competes with GE in aerospace, Automotive, and Control Solutions, Home Comfort, Turbocharger, and Aviation Management segments. The brand has continued to perform well despite a fast changing economic, geopolitical and technological scenario. Intensity of competitive rivalry in the industry: The intensity of competitive rivalry in the industry is high. Its outsourcing strategy is a mix of insourcing. His main goal in life is to help other people gain the knowledge, confidence, and expertise they need to succeed in their business ventures. Political forces have kept growing in relevance in the business world. Siemens revenues for the 3rd quarter2021 rose by 21 percent to 16.09 billion Euros from the previous year. Honeywells greatest asset is its track record of earning customer confidence over several years; it has earned a reputation as a trustworthy player delivering high-quality goods. Its segmentation strategy is tailored to focus on specific market segments. GE Industrial revenues kept flat for 2017 mainly due to a rise in industrial segment revenues of $3.3 billion offset by a decrease in Corporate revenues and Industrial eliminations of $3.3 billion. Hitachis revenue for March 31st, 2020, amounted to $78.85 billion. It operates in different segments including, aerospace, automation and control solutions, and performance materials & technologies. Customer loyalty: Due to its excellent products and services, GE has also managed very high level of customer loyalty. This acquisition will help GE healthcare expand its medical imaging market. In 2017, Siemens controlled 23.2 percent of the global diagnostic imaging market, followed closely by General Electric with 22.2 percent. While the investment in R&D in aviation has declined over years, in healthcare oil and gas and renewable energy, it has increased. GE operates and competes in five segments; Power & Water, Renewable energy, Aviation, Healthcare, and venture capital. Overall, the threat from new players remains negligibly low. This has also helped it grow it business a lot, helping it extend its business into new areas. Competitive pressure Competitive pressures on businesses have grown for several important reasons. Governments and government agencies have grown increasingly aggressive and are now trying stricter controls against businesses worldwide from EU to Asia.

Despite the Economic snarls of 2009, GE has managed to grow its revenues at a slower pace. The company employs a massive number of employees, about 174,000 all over the world. This section analyzes GEs competitors by looking at their strategies, core competencies, market presence, financials, and strengths & weaknesses.