Lets take three companies that all have net MRR growth of $10,000. Customer lifetime value (LTV) refers to the amount of money an individual spends with your business over the entire course of their time as a customer. For instance, if you have a SaaS business and also sell additional one-off services like setup fees, consultation or any other non-recurring payments, those shouldnt be counted towards your MRR. By boiling down some difficult questions about the health of your business to a number, you can get some insight into how you are doing at the moment or how your situation is changing over time. Enter your email address below and get instant updates as soon as new lessons are published. That means this business is primarily attracting users who arent paying them anything. As your customers team grows, theyll add additional users to their account, which creates expansion MRR for you. As always, make sure that you're using the same date ranges for both your expenses and acquisition. All MRR growth is not created equal. Monthly Recurring Revenue, while theoretically a simple metric to calculate, does have some intricacies and edge cases that can trip entrepreneurs up Metrics, in and of themselves, arent terribly interesting. Theres one thing you have to keep in mind though. While ACS is often overlooked, most companies are keenly aware of their CAC. The lost revenue could come from customers downgrading their plan, reducing the number of users on their plan, missing their payment or anything else that decreases the amount of money an existing customer pays you monthly. SaaS Financial Model. While the amount of incremental value you get out of each SaaS financial metric is variable, having all of them at your fingertips is one of the keys to success, which is why we are going through all of the SaaS financial metrics in this article. You need to experiment to find the sweet spot for your products pricing. Thats why most SaaS companies use tools like Baremetrics to handle the calculations for them. For instance, we show you customer churn broken down by cancellations and unpaid customers. Rather than only looking at your total number of users, look at how your active customers are growing over time. You can think of expansion MRR as the counter to contraction MRR. But first, lets talk about how to calculate the Quick Ratio for your SaaS company. Indeed, it is often one of the first questions asked by a venture capitalist when considering an investment. For most SaaS companies, anywhere from 5-7% churn rate is considered healthy. When you are earning revenue using a subscription revenue model, then you better know how much in subscription revenue you are bringing in! If you were grouping everyone together, you might think things are going well. A big mistake SaaS companies make when theyre calculating their ARPU is dividing their MRR by the total number of users. And just like you can gain MRR, you can also lose it from cancellations and contraction. At the end of the day its just reduce churn as much as possible. Its difficult to grow a SaaS business when the majority of your users arent paying you. Aside from the fact that youre earning less money, you also have to keep in mind that even though free users arent paying you, they still require resources to support them. Dont get me wrong, data is a lovely thing to Recurring revenue is the backbone of SaaS and subscription-based companies.

With great analytics tools, you can customize your reporting dashboards and always have an up-to-date calculation of LTV. Thats why its super important to actively analyze and reduce your churn. Its what makes building a SaaS so appealing. Manually calculating all of the SaaS reporting KPIs you measure each month is time-consuming, tedious, and leaves a ton of room for error. They have much less wiggle room than the other companies. Earlier stage companies who are focused on growth-at-all-cost are generally considered to have healthy growth with a Quick Ratio of 4, but less than that doesnt inherently imply that your company is failing or that youve got major issues. Whichever route you go, keep it consistent.  Baremetrics offers powerful reporting tools that make it easy to take total control of your SaaS reporting by doing the calculations for you. Like I said in the beginning, theres a laundry list of SaaS metrics you could measure. These numbers refer to the total regular income you can expect in a given amount of time, based on your subscribers. Some will include everything like advertising spend, salaries and tools, and others prefer to just include ad spend. In order to calculate CAC, divide all the expenses to acquire customers by the total number of customers acquired over a certain period of time. This excludes users on free trials, free plans, or are delinquent. Thats where Baremetrics comes in. Monthly recurring revenue (MRR) is the amount of revenue you get from your customers on a monthly basis. Conversion rate is closely tied to CACit refers to the number of leads who convert to customers. If you use Baremetrics, you can track your LTV over time: You can also see the LTV for any of your customers as well: We mentioned it earlier, but one of the main ways SaaS companies use LTV is to determine how much they should spend to acquire a new customer. With thousands of subscribers, subscribe to Academy for weekly updates from the team at Baremetrics about growing your business right. This is the percentage of customers that churned over a given period of time. Churn is the percentage of customers or revenue lost during a given period (usually monthly). It feels difficult to calculate, and then onc Recurring revenue is the lifeblood of any SaaS. If you had to calculate them all on your own, you wouldnt have time to do anything else. Churn rate refers to the percentage of customers or revenue lost in a given period. She writes for Baremetrics as part of her passion for tech and innovation. When he isnt helping others in the SaaS world bring their ideas to the market, you can find him relaxing on his patio with one of his newest board games. The more comprehensive you can make this calculationincluding wages, taxes, benefits, travel, meals, and any expense that can be attributed to getting visitors on your page and those visitors to sign up for your servicethe better.

Baremetrics offers powerful reporting tools that make it easy to take total control of your SaaS reporting by doing the calculations for you. Like I said in the beginning, theres a laundry list of SaaS metrics you could measure. These numbers refer to the total regular income you can expect in a given amount of time, based on your subscribers. Some will include everything like advertising spend, salaries and tools, and others prefer to just include ad spend. In order to calculate CAC, divide all the expenses to acquire customers by the total number of customers acquired over a certain period of time. This excludes users on free trials, free plans, or are delinquent. Thats where Baremetrics comes in. Monthly recurring revenue (MRR) is the amount of revenue you get from your customers on a monthly basis. Conversion rate is closely tied to CACit refers to the number of leads who convert to customers. If you use Baremetrics, you can track your LTV over time: You can also see the LTV for any of your customers as well: We mentioned it earlier, but one of the main ways SaaS companies use LTV is to determine how much they should spend to acquire a new customer. With thousands of subscribers, subscribe to Academy for weekly updates from the team at Baremetrics about growing your business right. This is the percentage of customers that churned over a given period of time. Churn is the percentage of customers or revenue lost during a given period (usually monthly). It feels difficult to calculate, and then onc Recurring revenue is the lifeblood of any SaaS. If you had to calculate them all on your own, you wouldnt have time to do anything else. Churn rate refers to the percentage of customers or revenue lost in a given period. She writes for Baremetrics as part of her passion for tech and innovation. When he isnt helping others in the SaaS world bring their ideas to the market, you can find him relaxing on his patio with one of his newest board games. The more comprehensive you can make this calculationincluding wages, taxes, benefits, travel, meals, and any expense that can be attributed to getting visitors on your page and those visitors to sign up for your servicethe better.

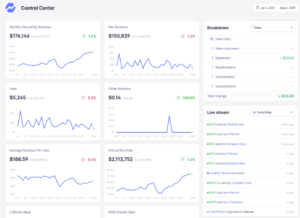

The crystal-clear dashboard gives you a holistic view of your revenue, expenses, and profit for a specified period. Use Baremetrics to measure churn, LTV and other critical business metrics that help them retain more customers.

But more importantly, Ill tell you why theyre important and what insights you can gain from eachin plain English. But the reality is that a lot of them arent things the average SaaS company is going to act on. The LTV can be calculated in many different ways, based on many different assumptions, but in essence it is the average amount billed monthly the average number of months a client uses your service before churning. Knowing what your MRR is, but setting realistic goals and taking steps to meet them is another. How you calculate the average amount billed monthly can vary from a straight line of their current plan to one that includes increments based on your expected expansion MRR. For instance, if two companies make a similar product and one charges $50/month while the other charges $25/month, the higher priced company can afford to spend a little more to acquire customers. Active customers are users who are currently paying to use your product. Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, total customers, and more. Theyre getting enough value from your product to keep paying you something, so all hope is not lost. Keep in mind that just increasing your prices wont magically improve your LTV:CAC ratio. You can also reach out to customers whove downgraded to find out why. You might not be able to quantify the value you get from your relationships in real life, but in the SaaS world, you can. Theres no magical number where you get bonus startup points. They have to accurately predict how long customers will maintain their subscriptions to forecast their financial future appropriately. It tells you just how effective your marketing and sales efforts are when looked at alongside your CAC. Plus, you can automate that process with ourMessaging tool. The LTV can take into account your ACS and/or CAC or be a straight revenue figure. But ARPU allows you to dig deeper into where your MRR comes from. It should only include revenue lost from customers who are still active. Enter your email address below and get instant updates as soon as new lessons are published. This can help you keep track of whether your customers are signing up for more services over time, an indication that you are developing services of value to your current customers. The best way to show the value of Quick Ratio is with an example. Start by tracking which plans users are downgrading from the most. And we show your revenue churn broken down by downgrades, failed charges and cancellations, so you can see where youre losing the most revenue. Also make sure your SaaS reporting is as effective as possible, be sure to look at these six SaaS KPIs regularly. When you start thinking in terms of ARPU instead of just MRR and total number of customers, youll realize there are other ways to grow revenue like upsells and pricing changes. Pricing changes: If youre able to earn more money from your customers, you have more flexibility on how much you can spend to acquire them. Ideally, your LTV should be greater than your CAC. Typically, when you hear about SaaS companies talk about their churn rate, theyre talking about customer churn (i.e. Financial reporting is critical for any business, and SaaS is no exception.

Youre bringing in more revenue than youre losing, and hopefully you have a healthy MRR growth rate (learn more about what MRR growth rate is and how to increase it here). For example, if you are worried about the cash flow of your business over the next few months, a quick look at your current ratio or quick ratio will tell you if things are all right or you have something to be genuinely concerned about. You can see this inBaremetrics. Of all the metrics you need to track as a SaaS company, lifetime value (LTV) may be the most mysterious. ARR is based on your current MRR, assuming that nothing else will change for the rest of the year. If your sales reps and marketers are dividing their time between acquisition and retention, be sure only to include the hours spent on acquisition. Average revenue per user (ARPU) is the average amount of revenue you earn from each of your active customers monthly. Monthly Recurring Revenue (MRR) & Annual Recurring Revenue (ARR). Are customers churning at a higher rate than usual? It can also be helpful for hiring, deciding how much to spend on marketing campaigns, etc. Heres an example of why measuring active customers is important: In the table above, you can see that the number of total users is growing significantly month over month. Sales is a tricky beast! Either way, its a red flag that you need to address. Looking at revenue churn lets you know the immediate impact on your MRR, while looking at customer churn helps you understand the longer-term implications for your brand and your customer lifetime value. Or if you charge per user, and the bulk of your contraction is coming from people reducing the number of users on their account, it could be that people dont see a need to have multiple user accounts. Theres no shortage of opinions on what the best Quick Ratio is, but at the end of the day, the higher the number, the better. Check out this article to learn more about ARPU and how to increase it. If you just want to know how many customers youre losing month-to-month, then customer churn is a good number to track. In fact, you might find this the best decision you have ever made as the customers that churned are likely the ones that didnt understand the value they were getting from your service and therefore complaining constantly.

Customer lifetime value (LTV) is an estimate of how much revenue youll make from the average customer before they churn. While the traditional and GAAP-approved metrics are important for SaaS as well, there are always specific SaaS financial metrics for every occasion, including the SaaS quick ratio.

Lets look at a few scenarios of how that company got its $10,000 in MRR growth and what the Quick Ratio would be. are the number of users who open and engage with your app/software in a day. Average monthly MRR per customer / User Churn Rate. Its a prediction of how much revenue your company will generate annually based on your current MRR. On the other hand, if your MRR is trending in the opposite direction, it could mean things are slowing down. Suppose your LTV is low and your customer churn is high. The Quick Ratio of a SaaS company is the measurement of its growth efficiency. For example, if you double the price of your service and lose 25% of your customers, then your customer churn value looks terrible, but your monthly revenue has actually gone up 50%. The more you understand about where your MRR comes from, and how its trending, the easier it is to make a strategy for growth. The archenemy of any SaaS company. Contraction MRR does not include customers whove cancelled. Meaning, if your average CAC is $100, you should get at least $300 from each customer before they churn. Get deep insights into MRR, churn, LTV and more to grow your business. Are you not bringing in as many new customers? But that skews your data. For example, if your monthly recurring revenue (MRR) is $100,000, and you have 1,000 active customers, your ARPU is $100 [$100,000 (MRR) / 1,000 (active customers)]. Annual run rate, or Annual Recurring Revenue, is your monthly recurring revenue (MRR) annualized. How reliable can a company grow revenue given its current churn rate? However, the basic calculations for current ARR/MRR are pretty easy: ARR/MRR = total number of active customers average billed amount (over one year/month). The reason DAU is important is because it gives you an understanding of the quality of users youre bringing in. Expansion MRR allows you to increase your revenue without having to acquire new customers. Were going to show you how to do just th Churn. If youre able to increase your ARPU, youll increase your MRR (assuming youre not losing more customers than youre gaining of course). Monthly Recurring Revenue / Active Customers. If youre curious about what your companys Quick Ratio is, you can see it in Baremetrics. They just group them all together and call them users. There are plenty of steps you can take to improve your contraction MRR. On any given month, our expansion MRR is greater than our MRR from new customers (you can check out our live dashboard here). That means your growth isnt 100% dependent on your ability to get new customers. But sometimes, you just want a quick look at how things are going and your growth trajectory.