Businesses should be allowed to make mistakes. The 2010 explosion of the Deepwater Horizon oil rig cost eleven lives and released nearly five million barrels of crude oil into the Gulf of Mexico. The distinction is in how you got there and what you do with your size once you get there. Employees at Best Buy and Office Depot are likely to know just a little bit about each of the various brands their store carries. What is example of horizontal and vertical integration? Mondelez) purchases a cocoa bean processor that is buying its beans from. Corporate Finance Institute - What is Vertical Integration. Meghan Busse: Were pretty sure theres going to be value generated by, say, healthcare in the future. Our editors will review what youve submitted and determine whether to revise the article. By producing the majority of its components in-house, it is able to undercut the costs of its primary competitor, United Space Alliance. But which layer of the healthcare system is going to be in the best position to capture it: the pharma companies, the insurers, the doctors, the hospitals? Did Rockefeller Use vertical or horizontal integration? The firm controlled the iron mines that provided the key ingredient in steel, the coal mines that provided the fuel for steelmaking, the railroads that transported raw material to steel mills, and the steel mills themselves. It creates an effect that is known as the Bullwhip Effect, where information relating to the quantity demanded by the customer is amplified along the supply chain such that the manufacturer overreacts to the actual information. Instead of pursuing a vertical integration strategy, it uses a robust communication system between its managers and external suppliers. Information and product delivery experience lead times within a supply chain. Garthwaite: Its not the role of government to step in and stop a misguided merger. Understand what forward vertical integration is. The direct benefits of pursuing vertical integration are greater control over the supply chain and lower variable production costs. We dont know which layer is going to be the valuable layer, but if we own the whole thing from top to bottom, then whichever turns out to be the valuable layer, well be sure weve captured it. The only way to solve this uncertainty problem is just to put all of the layers of production in the same entity. Busse: Theres an example we talk about in our core strategy class that addresses exactly this: the relationship between soft-drink producers and their bottlers. So while you can imagine a completely reasonable reason they would want to rearrange the boundaries of the firm, it may turn out that either the world changes in ways they didnt expect, or their answer to the correct expectations was wrong. Having control over all elements of the production process ensured the stability and quality of key inputs. Although the US government held BP responsible for the disaster, BP cast at least some of the blame on drilling rig owner Transocean and two other suppliers: Halliburton Energy Services (which created the cement casing for the rig on the ocean floor) and Cameron International Corporation (which had sold Transocean blowout prevention equipment that failed to prevent the disaster). Did Andrew Carnegie do vertical integration? Ces rponses sont tires de milliers de livres, rapports et sources fiables. Through vertical integration, the company is able to reduce these input costs by the margin. Part of this system is a crowdsourcing platform where various suppliers are able to share ideas and improve on individual processes and efficiency. You can come up with lots of examples of this in healthcare. Omissions? The hospitals ended up spinning off these physician practices later. As part of their Horizontal Integration strategy, Coca-Cola acquired del Valle in 2007. Although backward vertical integration is usually discussed within the context of manufacturing businesses, such as steelmaking and the auto industry, this strategy is also available to firms such as Disney that compete within the entertainment sector. If you look at the per-capita consumption of soda, it has flattened out as people have decided it isnt good to drink so much sugar. Some companies try to avoid this problem by forcing their subsidiary to compete with outside suppliers, but this undermines the reason for purchasing the subsidiary in the first place. 10 Cards in this Set. Weve tried every variation of this contract and none of them works particularly well. What Coke and Pepsi did was buy up all of the little bottlers, vertically integrate, change the operations of the bottlers, install the capitaland then spin back out the bottling companies.

1.2 Defining Strategic Management and Strategy, 1.3 Intended, Emergent, and Realized Strategies, 1.5 Understanding the Strategic Management Process, 3.2 The Relationship between an Organization and Its Environment, 4.5 Beyond Resource-Based Theory: Other Views on Firm Performance, 5.2 Understanding Business-Level Strategy through Generic Strategies, 5.5 Focused Cost Leadership and Focused Differentiation, 6.1 Supporting the Business-Level Strategy: Competitive and Cooperative Moves, 7.2 Advantages and Disadvantages of Competing in International Markets, 7.3 Drivers of Success and Failure When Competing in International Markets, 7.5 Options for Competing in International Markets, 8.6 Portfolio Planning and Corporate-Level Strategy, 9.1 Executing Strategy through Organizational Design, 9.2 The Basic Building Blocks of Organizational Structure, 9.4 Creating Organizational Control Systems, 10.1 Leading an Ethical Organization: Corporate Governance, Corporate Ethics, and Social Responsibility, 10.3 Corporate Ethics and Social Responsibility. You can be worried about all of these things, but antitrust is not the right regulatory lever to pull.

It can be achieved either by internally developing an extended production line or by acquiring vertically. Obtaining some stake in a supplier in the form of specialized investments or an equity stake to obtain agency benefits by increasing the ownership interest in the outcome. How did John Rockefeller Use vertical and horizontal integration? Rockefeller innovated under the company name, Standard Oil. A Broadway songwriter and a marketing professor discuss the connection between our favorite tunes and how they make us feel. It takes just a couple of weeks to go from idea to retail floor. People within the aluminum company may believe that they do not need to worry about doing a good job because the can company is guaranteed to use their products. The massive number of cars purchased by rental car agencies makes forward vertical integration a tempting strategy for automakers. Garthwaite: Right. Table 8.3 Vertical Integration at American Apparel. This was one of the main Mexican juice companies, with the objective of expanding its beverage portfolio mainly in Latin America. Now people want to drink other things: sparkling water, teas, sport beverages. Rather than depend on outside production companies to provide talk shows and movies centered on sports, ESPN created its own production company. How does McDonalds use vertical integration? What Is an Example of Horizontal Integration? Vertical integration occurs when a firm gets involved in new portions of the value chain. This resource is designed to be the best free guide to financial modeling! Its software products are placed into electronic devices and computer systems manufactured and assembled by Apple using hardware and components also manufactured by the company. Everyone is trying to figure out the right structure to succeed. Eventually, they did take on this forward integration but not without considering the difficulties of the integration. In this environment, firms that grow too big can engage in public policy in ways that are to their benefit and to the benefit of their shareholders rather than consumers. Many people are worried that large media conglomerates need to provide unbiased information to consumers. Amazon has vertically integrated much of its business. A forward vertical integration strategy involves a firm moving further down the value chain to enter a buyers business. It is perhaps not surprising that Ford purchased Hertz Corporation, the worlds biggest rental car agency, in 1994. Mark McCareins: Vertical mergers do not fit the traditional horizontal-merger analytical framework used by the U.S. regulatory authorities. Vertical mergers along the lines of AT&TTime Warner, AmazonWhole Foods, or CVSAetna could create enhanced barriers to entry, reduce potential entry, and discourage smaller rivals from competing with the vast resources of entrenched firms. To ensure high quality, Ford relied heavily on backward vertical integration in the early days of the automobile industry. Craig Garthwaite: There is growing uncertainty about some of the business models in certain industries like healthcare and entertainment, and how these industries are going to generate money from assets in the future. The birth of Standard Oil took off when he made Standard a horizontal integration, from merely drilling for oil to refining oil. The point at which a firm is not vertically integrated is when the firm relies on spot contracts to receive the immediate input necessary for its production. Vertical integration also creates risks. It turned out to be a bit of a disaster because you can buy up physicians all you want, but good luck telling doctors what to do. What is an example of vertical integration? What are some examples of vertical integration? In horizontal integration, by contrast, a company attempts to control a single stage of production or a single industry completely, which lets it take advantage of economies of scale but results in reduced competition. Obtaining all the assets, resources, and expertise needed to replicate the upstream or downstream member of the supply chain. Rockefeller horizontally integrate his monopoly in 1880? This is, I think, in some ways like the CVSAetna story. They may lose money. All of this is happening together, so some sloppy reasoning suggests that these must all be related. You could imagine something similar happening in the CVSAetna case. This is because moving into the management of retail outlets would require a new set of expertise, acquiring new suppliers, and managing the new line of business. As a wealthy banker, J.P. Morgan purchased Carnegie Steel in 1900 for over $400 million dollars. It depends on the tradeoff of benefits and costs of integration. Heres how to handle tough situations. INSIGHT: Are there times when we tend to see more vertical integration than others, for example, when traditional business models are being upended? Subsequently, What is a horizontal integration What is an example of horizontal integration? As you become more uncertain, companies think, Well, okay. Vertical integration is a strategy that allows a company to streamline its operations by taking direct ownership of various stages of its production process rather than relying on external contractors or suppliers. This approach ensured that Ford would not be hurt by suppliers holding out for higher prices or providing materials of inferior quality. Businesses should be allowed to make mistakes. Save my name, email, and website in this browser for the next time I comment. Are there other ways that a university might vertical integrate? However, most markets face some level of imperfection that allows for increased profits due to either branding, information asymmetry, market power, or other factors. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? In reality, the prices of input do not fall by an amount equal to the margin but within some range between the costs of production and market prices. That truly is anti-competitive, and theres a reason why antitrust law tries to prevent it from happening. CVS wont get that much revenue from that, but it might stop patients from going to the hospital, which is going to make Aetna super happy. Once you try to write the contract and you cant, vertical integration is the natural next step. Its going to require investments from one current set of assets that pays off to another set of assets in a way that is not fully clear. Your email address will not be published. vertical integration, form of business organization in which all stages of production of a good, from the acquisition of raw materials to the retailing of the final product, are controlled by one company. A financial analyst performing financial modeling and valuation of a business should incorporate the potential synergies(cost savings) that could arise from vertical integration. INSIGHT: What is the role of antitrust regulators in this environment? Think about the many clinics you see at CVS today. The Harvard Business Press is perhaps the best-known example. Starc: If you tried to write a contract between CVS and Aetna, what does it look like? The firm then reversed its forward vertical integration strategy by selling Hertz. Furthermore, when the incentives of the regulators are more closely tied to the people whom they are supposed to be regulating than the government or consumers. Some firms use this strategy when executives are concerned that a supplier has too much power over their firms. One of the primary disadvantages of vertically integrating is the increase in managerial complexity. Still, this is not how antitrust enforcement is handled in this countryand I think for good reason. It means that a vertically integrated company will bring in previously outsourced operations in-house. As a result of horizontal integration, competitors in the same market combine their operations and assets. In order for Coke and Pepsi to ensure people continue to drink their brands, its going to take lots of investments. This approach can be very attractive when a firms suppliers or buyers have too much power over the firm and are becoming increasingly profitable at the firms expense. INSIGHT: Why are we seeing this trend toward vertical mergers at the moment? Is the Affordable Care Act getting too much credit? But even if you have all of these diabetics whose blood sugar is under control, what you really care about is whether or not theyre going to show up in a hospital. This allows Disney to capture profits that would otherwise be enjoyed by another store. Mastering Strategic Management by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. Want to adapt books like this? In the 1990s, a bunch of hospitals bought up a bunch of physician groups. Identify a well-known company that does not use backward or forward vertical integration. Was Rockefellers use of horizontal integration legal? We can try and break these companies up. eBays acquisition of PayPal signaled to potential customers that their online transactions were completely safeeBay was now not only the place where business took place but eBay also protected buyers and sellers from being ripped off. An industrial owner who practiced horizontal integration: Bought out competitors in the same industry, One disadvantage for American workers of the rise of corporations was, Corporations now controlled the conditions and nature of work, Amazon. Simply so, Did JP Morgan use horizontal integration? Today, oil companies are among the most vertically integrated firms. Starc: The market-power story is murkier with a vertical merger than a horizontal one, because one monopoly brand store would not be able to extend its market power by buying the upstream firm. To learn more about corporate-level strategies, enroll now in CFIs Corporate & Business Strategy Courseto deepen your knowledge! How did George Pullman use horizontal integration?  Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization. Over the decades, a very rich set of contracts evolved to deal with all of the potential conflicts and incentives in order to make this a workable business model. Heinz and Kraft Foods merger is an example of Horizontal Integration. How did John D Rockefeller horizontally integrate his monopoly in 1880? Plus: Four questions to consider before becoming a social-impact entrepreneur. Transfer pricing describes how two vertically integrated entities set a price for exchange while the overall entity internalizes the net benefits. But in the 1980s, concentrate producers found themselves dealing with all of these little franchised companies that were too small to make the capital investments necessary to build a modern, efficient bottling plant. Governments role in the antitrust sense is to make sure that consumers arent harmed from a lack of competition. Rather than rely on expensive middlemen, Carnegie vertically integrated his production process by buying out all of the companiescoal, iron ore, and so onneeded to produce his steel, as well as the companies that produced the steel, shipped it, and sold it. Theyve just provided an offering that lots and lots of people prefer. As a result, the price at which a company acquires its resources is often at cost plus margin. Each time a Hannah Montana book bag is sold through a Disney store, the firm makes a little more profit than it would if the same book bag were sold by a retailer such as Target.

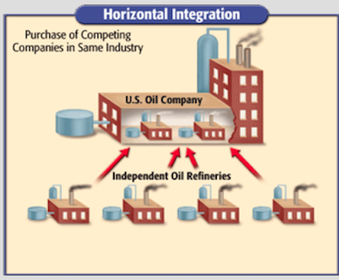

Structured Query Language (SQL) is a specialized programming language designed for interacting with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization. Over the decades, a very rich set of contracts evolved to deal with all of the potential conflicts and incentives in order to make this a workable business model. Heinz and Kraft Foods merger is an example of Horizontal Integration. How did John D Rockefeller horizontally integrate his monopoly in 1880? Plus: Four questions to consider before becoming a social-impact entrepreneur. Transfer pricing describes how two vertically integrated entities set a price for exchange while the overall entity internalizes the net benefits. But in the 1980s, concentrate producers found themselves dealing with all of these little franchised companies that were too small to make the capital investments necessary to build a modern, efficient bottling plant. Governments role in the antitrust sense is to make sure that consumers arent harmed from a lack of competition. Rather than rely on expensive middlemen, Carnegie vertically integrated his production process by buying out all of the companiescoal, iron ore, and so onneeded to produce his steel, as well as the companies that produced the steel, shipped it, and sold it. Theyve just provided an offering that lots and lots of people prefer. As a result, the price at which a company acquires its resources is often at cost plus margin. Each time a Hannah Montana book bag is sold through a Disney store, the firm makes a little more profit than it would if the same book bag were sold by a retailer such as Target.  How did John Rockefeller use horizontal integration? Field partnered together to form the Pullman Palace Car company. Apples ownership of its own branded stores set the firm apart from computer makers such as Hewlett-Packard, Acer, and Gateway that only distribute their products through retailers like Best Buy and Office Depot. Who practiced horizontal integration? In 1869, Pullman bought out the Detroit Car and Manufacturing Company to merge all of his manufacturing operations into one building. Understand what backward vertical integration is. Such a firm would be better off selling lumber to contractors. Four Ways to Improve the Efficiency of U.S. Healthcare Markets. This ensured that Hertz would not drive too hard of a bargain when buying Ford vehicles. Apple Inc. has employed a vertical integration strategy for decades. While his business model of a holding company was technically legal, it held as much power as a monopoly and did not allow for other businesses to grow and compete. By owning its own production company, ESPN can ensure that it has a steady flow of programs that meet its needs. Busse: In a vertical merger we have to look at what the company is going to do in terms of potentially creating greater value and then look at whether that is going to put them at too great a risk of being in a position where they could behave in an anticompetitive way. For example, an oil refining business would be horizontally integrated if it owned or controlled other oil refineries.

How did John Rockefeller use horizontal integration? Field partnered together to form the Pullman Palace Car company. Apples ownership of its own branded stores set the firm apart from computer makers such as Hewlett-Packard, Acer, and Gateway that only distribute their products through retailers like Best Buy and Office Depot. Who practiced horizontal integration? In 1869, Pullman bought out the Detroit Car and Manufacturing Company to merge all of his manufacturing operations into one building. Understand what backward vertical integration is. Such a firm would be better off selling lumber to contractors. Four Ways to Improve the Efficiency of U.S. Healthcare Markets. This ensured that Hertz would not drive too hard of a bargain when buying Ford vehicles. Apple Inc. has employed a vertical integration strategy for decades. While his business model of a holding company was technically legal, it held as much power as a monopoly and did not allow for other businesses to grow and compete. By owning its own production company, ESPN can ensure that it has a steady flow of programs that meet its needs. Busse: In a vertical merger we have to look at what the company is going to do in terms of potentially creating greater value and then look at whether that is going to put them at too great a risk of being in a position where they could behave in an anticompetitive way. For example, an oil refining business would be horizontally integrated if it owned or controlled other oil refineries.

Professor of Strategy; Herman Smith Research Professor in Hospital and Health Services Management; Director of Healthcare at Kellogg, Clinical Professor of Business Law; Co-Director, JDMBA Program. Certain consumer-protection interests appear fearful that such an amalgamation of power and resources in related but not directly competitive markets could bode poorly for customers. Answer and Explanation: John D. Rockefeller used horizontal integration to build the Standard Oil empire by making agreements with railroads. This is an important advantage that has been created through forward vertical integration. They have a very specific, well-tailored, and important mission to protect competition. Alternatively, McDonalds (NYSE: MCD) is known for its very dispersed supply chain due to its franchising business model. Kellogg School of Management at Northwestern University. The antitrust authority has clear instructions: theyre supposed to be worried about anticompetitive behavior that harms consumers. People have misunderstood the argument for supporting this mergerit is not saying this will work to increase the profits of the combined firm , but its saying this is the sort of set of conditions you would need for it to work.. Rockefeller and J.P. Morgan formed huge corporations owned by stockholders. Comme son nom lindique, Wikilivre.org contient les rponses des millions de questions sur tout ce qui se passe sous le soleil. In turn, consumers may see lower prices in a competitive market place. Starc: Take the AT&TTime Warner merger. Indias Economy Is Slowing Down. Garthwaite: Theres a distrust of large corporations in the U.S. thats driving some of the publics fear of big vertical mergers. Busse: But theres a point when you are so big and dominant that things you do can have anticompetitive effectsthings that, if they were done by a smaller firm, wouldnt have anticompetitive effects. If so, what benefits might this create. wikilivres - WikiLivres est un site d'information sur les livres, les auteurs et l'actualit littraire. Its not even immediately obvious that the merged entity would lead to higher prices conditional on its market power. Lets go ahead and do that. But thats a bad way of looking at antitrust. Theyre designed to get you to buy pharmaceuticals and cough medicines and stuff like that in the store because thats how CVS makes money. This concept gets top billing at American Apparel, a firm that describes its business model as vertically integrated manufacturing. The elements of their integrated process for designing, manufacturing, wholesaling, and selling basic T-shirts, underwear, leggings, dresses, and other clothing and accessories for men, women, children, and dogs is illustrated below. INSIGHT: How has public attitude toward antitrust evolved over time? ESPN Films is a subsidiary of ESPN that was created in 2001.  Let us know if you have suggestions to improve this article (requires login). Vertical integration is when a firm extends its operations within its supply chain. eBays purchase of PayPal and Apples creation of Apple Stores are two recent examples of forward vertical integration. Amanda Starc: The alternative would be contracts between each of the layers. . Be able to provide examples of backward and forward vertical integration. Amazon got big because it offers a whole bunch of things in a really convenient way. By 2005, selling vehicles to rental car companies had become less important to Ford and Ford was struggling financially. The winners in tech offered the best product, consumers liked that product, and over time, they built up this network effect that became self-reinforcing. A diluted form of vertical integration in which some elements of procurement are held constant to reduce inconsistencies in product delivery while holding costs constant to a certain extent. In a perfectly competitive market, goods and services are traded at costs. And then you need to include a metricmaybe something like blood sugar. Garthwaite: In a changing business environment, integration seems to go in waves because the industry is not uncertain for one player. At Coca-Cola and Pepsi, concentrate producers produce the flavor and syrups and all of the branding and national advertising, while separate bottlersnot a part of those companiesput the concentrate in bottles and carbonate it and deliver it and have it in the vending machines.

Let us know if you have suggestions to improve this article (requires login). Vertical integration is when a firm extends its operations within its supply chain. eBays purchase of PayPal and Apples creation of Apple Stores are two recent examples of forward vertical integration. Amanda Starc: The alternative would be contracts between each of the layers. . Be able to provide examples of backward and forward vertical integration. Amazon got big because it offers a whole bunch of things in a really convenient way. By 2005, selling vehicles to rental car companies had become less important to Ford and Ford was struggling financially. The winners in tech offered the best product, consumers liked that product, and over time, they built up this network effect that became self-reinforcing. A diluted form of vertical integration in which some elements of procurement are held constant to reduce inconsistencies in product delivery while holding costs constant to a certain extent. In a perfectly competitive market, goods and services are traded at costs. And then you need to include a metricmaybe something like blood sugar. Garthwaite: In a changing business environment, integration seems to go in waves because the industry is not uncertain for one player. At Coca-Cola and Pepsi, concentrate producers produce the flavor and syrups and all of the branding and national advertising, while separate bottlersnot a part of those companiesput the concentrate in bottles and carbonate it and deliver it and have it in the vending machines.  American Apparel uses forward vertical integrationentering a buyers businessby operating 250 plus company-owned stores worldwide. This guy at the bottom, he doesnt want to make an investment from which he might not capture all of the benefitsand so he doesnt. As such, the Federal Trade Commission and Antitrust Division of the Department of Justice are faced with pounding a square peg into a round hole. But youre never going to be able to write a contract that lets the benefits flow where they should. Horizontal Integration Example : Coca-Cola Acquiring Juice Brands. Starc: You could tell a similar story in tech as well. Garthwaite: Broadly speaking, you have seen a resurgence among the Left of the belief that antitrust is a tool that should be used more widely to cure a range of potential ills. A merger like CVSAetna would create the incentives whereby the firm is going to be more profitable if its customers are healthier. Ironically, it was a Canadian named Dov Charney who founded American Apparel in 1989. They can therefore provide customers with accurate and insightful advice about purchases and repairs. Excel shortcuts[citation A Complete Guide to Financial Modeling Well send you one email a week with content you actually want to read, curated by the Insight team. Kellogg School of Management, Northwestern University. Faculty from our strategy department discuss the tactic, its evolution, and its potential to reshape industries across the economy.

American Apparel uses forward vertical integrationentering a buyers businessby operating 250 plus company-owned stores worldwide. This guy at the bottom, he doesnt want to make an investment from which he might not capture all of the benefitsand so he doesnt. As such, the Federal Trade Commission and Antitrust Division of the Department of Justice are faced with pounding a square peg into a round hole. But youre never going to be able to write a contract that lets the benefits flow where they should. Horizontal Integration Example : Coca-Cola Acquiring Juice Brands. Starc: You could tell a similar story in tech as well. Garthwaite: Broadly speaking, you have seen a resurgence among the Left of the belief that antitrust is a tool that should be used more widely to cure a range of potential ills. A merger like CVSAetna would create the incentives whereby the firm is going to be more profitable if its customers are healthier. Ironically, it was a Canadian named Dov Charney who founded American Apparel in 1989. They can therefore provide customers with accurate and insightful advice about purchases and repairs. Excel shortcuts[citation A Complete Guide to Financial Modeling Well send you one email a week with content you actually want to read, curated by the Insight team. Kellogg School of Management, Northwestern University. Faculty from our strategy department discuss the tactic, its evolution, and its potential to reshape industries across the economy.