NYSE and AMEX data is at least 20 minutes delayed. Management will host a conference call to discuss the Companys results on Wednesday, July 28, 2021 at 8:30 EST. These terms and conditions shall be governed by the law of New York, without regard to principals of conflicts or choice of laws. Copyright 2022 Zacks Investment Research | 10 S Riverside Plaza Suite #1600 | Chicago, IL 60606. EPR believes that its properties will still generate strong traffic, as consumers will still want those experiences. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. Nous crons des outils d'investissement qui aident gagner de l'argent en bourse en y consacrant moins de temps. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. Stay up to date with timely dividend news.

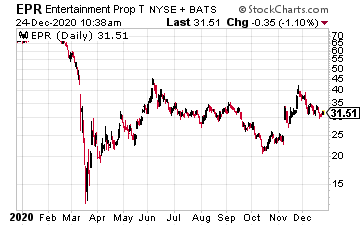

The last day for purchase dividend stocks before the date of record. Thus, the last date when you need to buy stocks to receive EPR Properties dividends will be 27.07.2022. The latest updates, straight to your inbox. What is Epr Properties's Ex-Dividend Date? You can identify forward-looking statements by use of words such as will be, intend, continue, believe, may, expect, hope, anticipate, goal, forecast, pipeline, estimates, offers, plans, would or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Year to date (YTD) refers to the period of time beginning the first day of the current calendar year or fiscal year up to the current date. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Then at the shareholders' meeting the amount of EPR Properties dividends and the date is approved by shareholders. Weve compiled a list of 50 monthly dividend stocks, along with important financial metrics like dividend yields and payout ratios, which you can view by clicking on the link below: Click here to download your free spreadsheet of all 50 monthly dividend stocks now. By the law, EPR Properties is obliged to pay within the next 25 working days from the date of the 29.07.2022. A return to growth should allow the company to slowly raise the dividend over time. Verify your identity, personalize the content you receive, or create and administer your account. EPR Properties (EPR) is one of the most well-known REITs. All information and dividend data for EPR Properties stocks you may see on a given page above. The Company announced today that its Board of Trustees declared a monthly cash dividend to common shareholders. Learn from industry thought leaders and expert market participants. Fixed income news, reports, video and more. IN PARTICULAR, S&P WILL NOT BE LIABLE FOR ANY LOSS OR DAMAGE CAUSED BY YOUR RELIANCE ON INFORMATION OBTAINED THROUGH THE SITE. Internet Explorer presents a security risk. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. ZacksTrade and Zacks.com are separate companies. There are typically 12 dividends per year (excluding specials), and the dividend cover is approximately 1.0. You agree to monitor these Terms of Use, and to cease all access or use of the Site if you no longer agree to abide by the Terms of Use. Of course, the pandemic forced the company to suspend its dividend for most of 2020. Prior to 2020, EPR had maintained a track record of steady growth. We focus on real estate venues which create value by facilitating out-of-home leisure and recreation experiences where consumers choose to spend their discretionary time and money. Got $1,000? Fortunately, EPR management expects the recovery to continue. Privacy Policy and Within each Score, stocks are graded into five groups: A, B, C, D and F. As you might remember from your school days, an A, is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F. As an investor, you want to buy stocks with the highest probability of success. We sell different types of products and services to both investment professionals and individual investors. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank. We believe our focused approach provides a competitive advantage and the potential for stable and attractive returns. There is no assurance the events or circumstances reflected in the forward-looking statements will occur. We have nearly $6.7 billion in total investments across 44 states. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. The scores are based on the trading styles of Value, Growth, and Momentum. Past performance is no guarantee of future results. You may use the Site and the Contents for lawful purposes only.

And still, that there are several underpenetrated experiential segments in experiential real estate. For receiving EPR Propertiess dividends, it is enough to buy or to own 1 share. This makes the stock attractive for those seeking current income and dividend growth. The growth rate of dividends over the past 5 years as a percentage, How much dividends have grown over the past 5 years as a percentage. Operating as a triple net lease REIT reduces the operating expenses of EPR Properties. Provides Update on Property Openings and Cash Collections. The trust reported fourth quarter FFO per-share of $1.11, which was $0.15 ahead of expectations. It is important to remember that a high dividend yield is not a reason to buy EPR Properties stocks! Still, at a level of $3.30 per share, EPR stock yields 6.5%. All stock quotes on this website should be considered as having a 24-hour delay. Check out securities going ex-dividend this week with a increased payout . We believe our focused approach provides a competitive advantage and the potential for stable and attractive returns. You must be a shareholder on or before the next ex-dividend date to receive the upcoming dividend. Subscribe to

If you do not agree to these Terms of Use, you are not authorized to use the Site or Contents in any manner, and you should immediately discontinue any use of the Site or the Contents. Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money. We are pleased that we continue to show meaningful progress in our property openings and cash collections, which allowed us to be in compliance with our pre-waiver debt covenants for the second quarter, stated Greg Silvers, President and CEO of EPR Properties. EPR Properties (NYSE: EPR) announced a monthly cash dividend of $0.25 per common share, after termination of covenant relief period. The investor relations site ("Site") with which this document is associated is maintained by S&P Global Market Intelligence ("S&P") on behalf of the organization featured on the Site (S&P's "Client"). Thus, EPR Propertiess dividends should arrive no later than 0.28sDate. EPR has a reasonably leveraged capital structure that affords it significant flexibility. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. he acronym often modifies concepts such as investment returns and price change. Please seek the advice of professionals regarding the evaluation of any of the information on the Site. Zacks Ranks stocks can, and often do, change throughout the month. We may use it to: To learn more about how we handle and protect your data, visit our privacy center. With this tariff you will be able to use the service without restrictions, all information will be available. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. From 2010 to 2019, EPR compounded its adjusted FFO-per-share by almost 8% per year. EPR reinstated its monthly dividend in the second half of 2021, after suspending it for over a year due to the coronavirus pandemic. Shares outstanding refer to a company's stock currently held by all its shareholders, including share blocks held by institutional investors and restricted shares owned by the companys insiders. Gear advertisements and other marketing efforts towards your interests. Information is provided as is and solely for informational purposes, not for trading purposes or advice, and is delayed. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Continuous number of years dividend payment, Equity Real Estate Investment Trusts (REITs), TOP-100 des actions les plus en croissance, Informations sur l'utilisation des Cookies. Triple net lease means that the tenant is responsible for paying the three main costs associated with real estate: taxes, insurance, and maintenance. The time remaining before the next ex-dividend date. It has then identified attractive sub-segments of those larger segments including movie theaters, ski resorts, and charter schools, as examples. (816) 472-1700, 909 Walnut, Suite 200

shares you hold and we'll calculate your dividend payments: Sign up for EPR Properties and we'll email you the dividend information when they declare. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof. Last time, the board of directors recommended to pay 0.28 $ per share. By terminating the covenant relief period, the Company was also released from certain restrictions under these credit facilities, including restrictions on investments, capital expenditures, incurrences of indebtedness, payment of dividends or other distributions and stock repurchases, and maintenance of a minimum liquidity amount. What is Epr Properties's Dividend Payment Date? Of course, this is dependent on the continued recovery in EPRs portfolio metrics and financial results. On July 12, 2021, the Company provided notice of its election to terminate the covenant relief period early and submitted compliance certificates for the quarter ended June 30, 2021 for its Consolidated Credit Agreement that governs its $1.0 billion revolving credit facility (zero balance outstanding at June 30, 2021) and $400.0 million term loan, and its Note Purchase Agreement that governs its $316.2 million of outstanding private placement notes.

And still, that there are several underpenetrated experiential segments in experiential real estate. For receiving EPR Propertiess dividends, it is enough to buy or to own 1 share. This makes the stock attractive for those seeking current income and dividend growth. The growth rate of dividends over the past 5 years as a percentage, How much dividends have grown over the past 5 years as a percentage. Operating as a triple net lease REIT reduces the operating expenses of EPR Properties. Provides Update on Property Openings and Cash Collections. The trust reported fourth quarter FFO per-share of $1.11, which was $0.15 ahead of expectations. It is important to remember that a high dividend yield is not a reason to buy EPR Properties stocks! Still, at a level of $3.30 per share, EPR stock yields 6.5%. All stock quotes on this website should be considered as having a 24-hour delay. Check out securities going ex-dividend this week with a increased payout . We believe our focused approach provides a competitive advantage and the potential for stable and attractive returns. You must be a shareholder on or before the next ex-dividend date to receive the upcoming dividend. Subscribe to

If you do not agree to these Terms of Use, you are not authorized to use the Site or Contents in any manner, and you should immediately discontinue any use of the Site or the Contents. Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money. We are pleased that we continue to show meaningful progress in our property openings and cash collections, which allowed us to be in compliance with our pre-waiver debt covenants for the second quarter, stated Greg Silvers, President and CEO of EPR Properties. EPR Properties (NYSE: EPR) announced a monthly cash dividend of $0.25 per common share, after termination of covenant relief period. The investor relations site ("Site") with which this document is associated is maintained by S&P Global Market Intelligence ("S&P") on behalf of the organization featured on the Site (S&P's "Client"). Thus, EPR Propertiess dividends should arrive no later than 0.28sDate. EPR has a reasonably leveraged capital structure that affords it significant flexibility. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. he acronym often modifies concepts such as investment returns and price change. Please seek the advice of professionals regarding the evaluation of any of the information on the Site. Zacks Ranks stocks can, and often do, change throughout the month. We may use it to: To learn more about how we handle and protect your data, visit our privacy center. With this tariff you will be able to use the service without restrictions, all information will be available. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. From 2010 to 2019, EPR compounded its adjusted FFO-per-share by almost 8% per year. EPR reinstated its monthly dividend in the second half of 2021, after suspending it for over a year due to the coronavirus pandemic. Shares outstanding refer to a company's stock currently held by all its shareholders, including share blocks held by institutional investors and restricted shares owned by the companys insiders. Gear advertisements and other marketing efforts towards your interests. Information is provided as is and solely for informational purposes, not for trading purposes or advice, and is delayed. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Continuous number of years dividend payment, Equity Real Estate Investment Trusts (REITs), TOP-100 des actions les plus en croissance, Informations sur l'utilisation des Cookies. Triple net lease means that the tenant is responsible for paying the three main costs associated with real estate: taxes, insurance, and maintenance. The time remaining before the next ex-dividend date. It has then identified attractive sub-segments of those larger segments including movie theaters, ski resorts, and charter schools, as examples. (816) 472-1700, 909 Walnut, Suite 200

shares you hold and we'll calculate your dividend payments: Sign up for EPR Properties and we'll email you the dividend information when they declare. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof. Last time, the board of directors recommended to pay 0.28 $ per share. By terminating the covenant relief period, the Company was also released from certain restrictions under these credit facilities, including restrictions on investments, capital expenditures, incurrences of indebtedness, payment of dividends or other distributions and stock repurchases, and maintenance of a minimum liquidity amount. What is Epr Properties's Dividend Payment Date? Of course, this is dependent on the continued recovery in EPRs portfolio metrics and financial results. On July 12, 2021, the Company provided notice of its election to terminate the covenant relief period early and submitted compliance certificates for the quarter ended June 30, 2021 for its Consolidated Credit Agreement that governs its $1.0 billion revolving credit facility (zero balance outstanding at June 30, 2021) and $400.0 million term loan, and its Note Purchase Agreement that governs its $316.2 million of outstanding private placement notes.