to variation. protected nor poorly secured. Fitch and Standard & Poors (S&P) are the others. Ba classification, earnings and asset protection are, nevertheless, Rating shopping describes instances where an issuer refuses to engage in discussions with an agency that gives a less favorable perspective on an issuer's creditworthiness and instead "takes its business" to agencies that provide the highest ratings. Our ability to consider sensitive information judiciously, and not to unnecessarily reverse ratings over short periods of time because we are "surprised" by new information, is highly valued by most market participants, including many regulatory bodies. These ratings are publicly available and cover a wide range of markets, industries, and geographies. An issue rated "b" As the Staff of the Senate Governmental Affairs Committee said in a recent report, "[i]f history is a guide, credit rating agencies generally get it right. We believe that vigorous competition has advantages and disadvantages in promoting these primary objectives. principal payments may be very moderate, and thereby not well modifiers 1, 2, and 3 in each generic rating classification from Aa Unpublished Monitored Private Placement Rating, Private Monitored Private Placement Rating, Contract Enforceability Indicator for Mexican States. Issues so rated can thus be regarded Some market participants initiated market destabilizing acts, some were complicit in allowing them to occur, and some - notably market watchdogs, including rating agencies - either did not identify or did not judge the severity of certain actions in ways that would have maximized investor protection. maturity in excess of one year. Ca judged to have speculative elements; their future cannot be These obligations have an original maturity The rating is then delivered through a press release available on. 2022 Moodys Corporation, Moodys Investors Service, Inc., Moodys Analytics, Inc. and/or their licensors and affiliates (collectively, MOODYS). good and bad times over the future. Connect with a Relationship Manager to answer your questions about Moodys ratings process. Moodys Corporation was formed and became a publicly traded company in 2000, listed on the New York Stock Exchange (NYSE) under the ticker MCO. time. situation.

Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Learn how Moody's ratings and analysis speak to the relative credit risk of debt instruments and securities across industries and asset classes around the globe. By using this service, you agree to input your real email address and only send it to people you know. The predictive content and performance history of Moody's ratings is measurable, measured, and published each year-both in the form of Moody's Default Studies, and through third-party academic analysis and commentary. It reviews, votes and assigns the rating. Moody's Corporation., Moodys Analytics.

In closing, Moody's would like to thank the Commission for the opportunity to participate in these important proceedings. often be evidenced by many of the following characteristics: Prime-2 Issuers rated Prime-2 (or Adequate alternate liquidity is maintained. Neither result is "wrong". senior debt obligations. It is important to monitor a bond's rating regularly. often in default or have other marked shortcomings. The market reviews the work of rating agencies on a daily basis. Obligations relying upon support She covers topics such as stock investing, budgeting, loans, and insurance, among others. Yet there are instances where we may not believe that the numbers provided or the representations made by issuers provide a full and accurate story. Moodys global long-term and short-term rating scales are forward-looking opinions of the relative credit risks of financial obligations. Of course, there is a risk of loss at every rating, including investment-grade ratings.

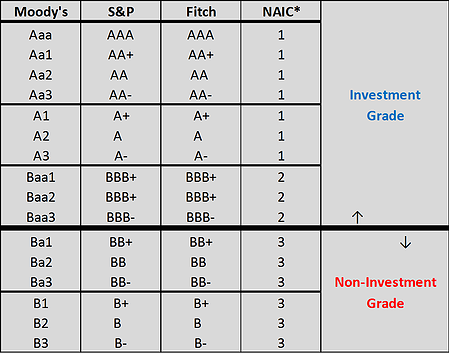

In closing, Moody's would like to thank the Commission for the opportunity to participate in these important proceedings. often be evidenced by many of the following characteristics: Prime-2 Issuers rated Prime-2 (or Adequate alternate liquidity is maintained. Neither result is "wrong". senior debt obligations. It is important to monitor a bond's rating regularly. often in default or have other marked shortcomings. The market reviews the work of rating agencies on a daily basis. Obligations relying upon support She covers topics such as stock investing, budgeting, loans, and insurance, among others. Yet there are instances where we may not believe that the numbers provided or the representations made by issuers provide a full and accurate story. Moodys global long-term and short-term rating scales are forward-looking opinions of the relative credit risks of financial obligations. Of course, there is a risk of loss at every rating, including investment-grade ratings. date of maturity or maturities or rating expiration date and Moodys rating scale, which ranges from a maximum Aaa to a minimum C, consists of 21 notches and two categories: Highest quality, subject to the lowest level of credit risk, High quality, subject to very low credit risk, Upper-medium grade, subject to low credit risk, Medium-grade, subject to moderate credit risk and may possess certain speculative characteristics, Judged to be speculative, subject to substantial credit risk, Considered speculative, subject to high credit risk, Speculative of poor standing and subject to very high credit risk, Speculative and likely in, or very near, default, with some prospect of recovery of principal and interest, The lowest rated and typically in default, with little prospect for recovery of principal or interest, Alexander Vollert to join AXA's Management Committee, 2026 Indian life insurance market forecasts, AM Best confirms Al Dhafra Insurance Company's rating, MENA market: insurance premiums increase in 2021, Four African brokers to join Brokerslink's network, El Halla Najem, new Chairman of the Traffic Accidents Guarantee Fund (FGAC), AXA to sell a life and pension insurance portfolio in Germany, Emerging Asia, key driver of global insurance growth, Global insurance market projections for 2022 and 2023, Senior management reshuffles within five Algerian public insurance and reinsurance companies, Cameroonian insurance market: premium growth in 2021, Chinese insurers maintain a high solvency level, Lloyd's Europe, appointment of a Chief Underwriting Officer, Total staff: 12 300 staff members worldwide. judged to be of high quality by all standards. This phase may be accelerated in situations with tighter financing schedules, or for structured finance deals. elements of danger with respect to principal or interest. considered to have speculative elements and its future cannot be investment standing. We appreciate this opportunity to contribute our views to the discussion that is currently under way at the Commission regarding credit rating agencies. not exceeding one year, unless explicitly noted. It is likely that the difficult issues that will confront credit rating agencies in the future will be different from those in the public eye today, and it is imperative that credit rating agencies retain the flexibility necessary to meet these future demands. An issue rated "ca" is Just as individuals have their own credit report and rating issued by credit bureaus, bond issuers generally are evaluated by their own set of ratings agencies to assess their creditworthiness. Rating for the Bank Deposits for the country in which the branch is retirement of the obligation while VMIG rating expiration will be a supporting institutions) have a strong ability for repayment of An issue rated "aa" is Economists call this a "collective action" problem. Surveillance and dialogue is maintained with organizations for timely and relevant ratings. to have speculative elements; their future cannot be considered as Much of the innovation in Moodys rating system is a response to market needs for clarity around the components of credit risk or to demands for finer distinctions in rating classifications. In general, the lower the credit rating, the higher the yield. large as in the preceding group. The following statement is submitted by Moody's Investors Service ("Moody's") to the Securities and Exchange Commission (the "Commission") in connection with the Commission's hearings scheduled for November 15 and November 21, 2002 on issues relating to credit rating agencies and their role and function in the operation of the securities markets.

comparison with bond quality in absolute terms. Bonds rated Aa are considered to be a medium-grade preferred stock, neither highly bank's ability to repay senior obligations extends only to branches Investors also have a broad choice in the selection of investments, and so are most interested in the general application of ratings, rather than in a rating on any single bond. Issuers have historically been able to provide non-public information to rating agencies for the purposes of assigning or maintaining a rating. A rating should be weighed solely as one factor in an of the words "Dutch auction" into the name of the issue. lack characteristics of the desirable investment. A credit rating assesses an organizations creditworthiness and the likelihood of default, which provides a valuable ranking tool for analyzing an investment. differences between preferred stocks and bonds, a variation of our associated with scheduled principal and interest payments, and the whether payment of the obligation will be affected by the actions of reinvested in direct non-callable United States government As explained above, Moody's and the other credit rating agencies operate within a framework wherein our ratings are used by entities with opposing goals and desires. That is to say, the public availability of ratings for investors combined with the relative indifference of investors versus issuers to the absence of a rating on any single bond. Each The issuer prepares their company information and presentation for the first meeting with the Moody's analytical team.